3 of the best movies of all time, all of which earned a 100% on Rotten Tomatoes

If you believe Jerry Seinfeld’s gloomy assessment of the movie business — that, in his words, it’s over, to put it bluntly — then it …

If you believe Jerry Seinfeld’s gloomy assessment of the movie business — that, in his words, it’s over, to put it bluntly — then it …

The iOS 17.5 beta cycle just started, and this might be Apple’s last iOS 17 update for iPhone users before it unveils iOS 18 during …

The main attraction of WWDC 2024 will be iOS 18, and all the AI features that Apple is building into the iPhone’s operating system. The …

This year, we expect a significant design change for the Apple Watch with the Series 10 release. However, an Apple Watch Ultra 3 apparently won’t …

Apple’s MacBook lineup is super popular, and for good reason. The latest MacBook Air and MacBook Pro laptops have powerful M series chips and killer …

For the second week in a row, one of the unlikeliest dramas is dominating the weekly Netflix Top 10 chart. That show is Baby Reindeer, …

Hisense has made a name for itself in the value television market. Need a TV with some newer features but don’t want to pay the …

Ahead of the official iOS 18 announcement on June 10, several reports have highlighted what we could expect from the iPhone’s upcoming operating system. Now, …

I’ve taken the iPhone’s Find My app for granted ever since it debuted. It lets me track the handset and enables Activation Lock. This is …

I’m not big into betting, but if I was, I would bet a lot of money that $179 is the best price we’re going to …

Less than a week from now, Apple will hold its Let Loose event, where the company is expected to announce a powerful iPad Pro with …

iOS 18 is Apple‘s upcoming operating system for its iPhone models, including the rumored iPhone 16. Expected to be announced during the WWDC 2024 keynote, …

Google’s Pixel Fold smartphone and the Pixel 7a were the company’s most talked-about smartphones until late last year. That’s when Google unveiled the exciting new …

After the iPhone 15 release, we turn our attention to Apple’s upcoming iPhone 16. This new series is expected to be announced later in 2024. …

The Rabbit r1 AI gadget was one of the highlights of this year’s CES event in January. At the time, I said the gadget almost …

There are Echo Dot deals all the time at Amazon. That is surely a big part of the reason why it’s the single best-selling Alexa …

Some of the biggest shows on Prime Video right now have obvious traits in common. They’re often loud, action-packed, and generally riotous affairs, whether we’re …

It’s completely despicable, but not in the least surprising, that scammers have turned to dating apps to find their latest victims. The FBI recently published …

For those of us who love a good spy drama, the Apple TV+ series Tehran is simply one of the best that any of the …

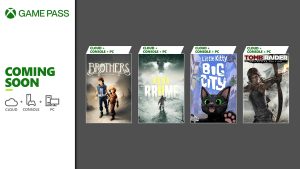

It’s a new month which means that it’s time for a new round of games coming to Xbox and PC Game Pass! However, with every …

Some iPhone bugs are worse than others. Apple confirmed something that has been spreading on social media to Today. Some users’ alarms are triggering silently. …

Even though there are only 31 movies and shows leaving Netflix this May, there are some pretty big hitters on the list. Trying to watch …

![Xbox event Xbox Games Showcase Followed by [REDACTED] Direct Airs June 9](https://bgr.com/wp-content/uploads/2024/04/Xbox-Games-Showcase-2024-Hero-a6dc9c9fda53f2ec5484.jpg?quality=82&strip=all&w=300&h=169&crop=1)

Well, isn’t this a mysterious way to announce an Xbox Games Showcase? As if the Xbox community wasn’t pumped enough already, Phil Spencer and team …

A big iPad Pro rumor dropped over the weekend that I didn’t see coming. A well-known Apple reporter said the OLED iPad Pro that will …

AirPods are unquestionably among the most popular headphones in the world. It’s great that there’s so much variety in the Apple AirPods lineup, but the …

Roku’s home screen has become one of the few bastions of peace and quiet on our screens as other streamers pack their apps with video …

tvOS 17.5 beta 4 is now available to everyone with an Apple TV that can run tvOS. At this moment, it’s unclear what this operating …

watchOS 10.5 beta 4 is now available to Apple Watch users. After a mild update with watchOS 10.4, it seems this next version won’t bring many …

A week after visionOS 1.2 beta 3, Apple is now seeding its fourth testing version. Although it’s unclear what’s new with this update, Apple is …

Apple has just released macOS 14.5 beta 4 to developers. At this moment, it’s unclear what features this software update might bring, as we haven’t …

As the testing cycle of iOS 17.5 is nearing its end, Apple has just released beta 5 to developers. This might be Apple’s last iOS 17 update …