One of Prime Video’s best new series just debuted with a 100% on Rotten Tomatoes

Prime Video may have a new hit series on its hands. Them: The Scare is a newly debuted eight-episode series that just dropped all at …

Prime Video may have a new hit series on its hands. Them: The Scare is a newly debuted eight-episode series that just dropped all at …

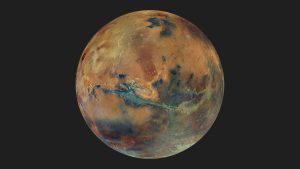

The European Space Agency’s Mars Express has captured images of spiders on Mars. However, the “spiders” aren’t the usual insects you would expect when hearing …

For as unbelievably popular as the Switch turned out to be, Nintendo’s newest console doesn’t exactly have the best primary controllers. The Joy-Con (L) and …

Lisa Kaltenegger, who currently directs the Carl Sagan Institute at Cornell, recently told The Telegraph that announcements of alien life discovery are imminent and that …

Although I’d love to sit around playing games all day, I have a job, so other than the occasional lunch break, I have to save …

The newly debuted second season of Velma on Max is so bad, it’s not even worth a hate watch. That’s according to one of the …

watchOS 11 is Apple’s upcoming operating system for Apple Watch models. After rebuilding the OS from the ground up with watchOS 10, the next version …

The University of Maine just revealed the world’s largest 3D printer, and it is an absolute beast. The printer, which the university named Factory of …

The big news is that there are some Amazon gift card deals that anyone and everyone should take advantage of immediately. Altogether, there’s more than …

In late 2024, Apple is expected to introduce the Apple Watch Series 10 – or Apple Watch X. This smartwatch will mark ten years of …

The iPhone has a hidden “night vision” feature that turns your screen red. More than giving a spy movie vibe, a red screen could help …

When Amazon released the first batch of Fire Tablets, it was pretty clear what the company’s intention was. As is the case with many of …

Well, we made it exactly four months into the new year before we’re already talking about this year’s big sales events. Great work, everyone. Maybe …

On Friday, we have an exclusive deal that gets you the powerful and compact GEEKOM Mini IT11 mini PC for just $399! All you need …

These past few weeks have highlighted the escalating tension between the US and China. Still, Apple and its CEO, Tim Cook, are doing everything to …

Apple’s MacBook Pro lineup is still the go-to laptop series for Apple fans who really need tons of power. If you edit video for a …

One of the best things I read on the internet this week was Edward Zitron’s deep dive into the decline of Google Search, offering not …

There were plenty of reasons to get excited about Deadpool & Wolverine, but now we have one more, as a prolific leaker has teased an …

Remember all the dismissiveness and whispers that were prevalent back in the early days of Apple TV+? There was a time, for example, when the …

While the Apple Card has been in people’s wallets for a few years now, the company has done a pretty terrible job at marketing where …

Done with Fallout and looking for something new to binge? This Thursday, Netflix unleashed all eight episodes of its new supernatural dramedy series Dead Boy …

Researchers may have found a realistic alternative to plastic. The alternative comes in the form of a newly developed “bioplastic” pellet, which could prove to …

Apple is expected to announce a new iPad Pro on May 7. After a mild M2 update in late 2022, rumors indicate a significant refresh …

Netflix has a mixed track record, to say the least, when it comes to original movies. It’s poured serious money into chasing a Best Picture …

For the past five years, the Epic Games Store has been giving away free PC games each and every week. If you’re looking to boost your …

iOS 17 is Apple‘s current operating system for its iPhone models. Announced during the WWDC 2023 keynote, the Cupertino firm focused on three main features: …

Where can you get the best tech deals online? Look no further, because there are so many incredible sales available to shop. Our expert commerce …

Remember the good old days when you could escape from a never-ending meeting by simply leaving your laptop behind? “Hey guys, I have to get …

You don’t have to read our guide on the best Sony headphones and earbuds to know that Sony is a leader in the headphones market. …

By Kirstie McDermott Remote work triumphed during the pandemic, but in the time since, tech firms have been shepherding their staff back into the office. …