Not enough people are watching this sweet British comedy on Apple TV+

From TV gems like Acapulco and Ted Lasso to less obvious examples like Eugene Levy’s travel show and even a drama like Drops of God, …

From TV gems like Acapulco and Ted Lasso to less obvious examples like Eugene Levy’s travel show and even a drama like Drops of God, …

The big news is that there are some Amazon gift card deals that anyone and everyone should take advantage of immediately. Altogether, there’s more than …

watchOS 10.5 beta 3 is now available to Apple Watch users. After a mild update with watchOS 10.4, it seems this next version won’t bring many …

A week after seeding a new beta build of the second visionOS 1.2, Apple is now seeding its third testing version. Although it’s unclear what’s …

tvOS 17.5 beta 3 is now available to everyone with an Apple TV that can run tvOS. At this moment, it’s unclear what this operating …

Apple has just released macOS 14.5 beta 3 to developers. At this moment, it’s unclear what features this software update might bring, as we haven’t …

Apple just released iOS 17.5 beta 3 to developers. This might be Apple’s last iOS 17 update for iPhone users before it unveils iOS 18 during the WWDC 2024 keynote …

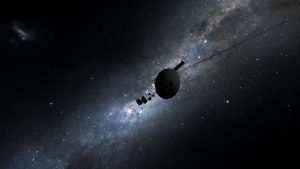

After five months of gibberish, Voyager 1 is finally talking to NASA again. The 46-year-old probe randomly started submitting funky data to NASA back in …

iPad users rejoiced once Apple introduced the Weather app in 2022 with iPadOS 16. However, another iPhone software was still missing from this release, which …

The Samsung Galaxy Tab A8 tablet is one of the best all-around tablets that Samsung makes. It’s the ideal balance between price and performance, giving …

Apple usually holds spring events. With several rumors about new products, the company may be considering a presentation for the next month before it unveils …

Today, Apple announced a special event for May 7. The company will likely announce the new iPad Pro, iPad Air, Apple Pencil 3, and Magic …

There are so many great daily deals out there on Tuesday that we almost don’t know where to start. How about popular Nooie smart plugs …

Sonos has always been one of the companies that supports a heck of a lot of audio-based services. From music streaming services to podcast players …

Over the weekend, a leaker declared that FineWoven cases were done, and Apple would move on to a new fabric for its premium cases. Surrounded …

Apple’s AirPods 3 are among the most popular earbuds out there right now. That’s to be expected, of course, since AirPods are super popular in …

For being as necessary as they are to the orderly functioning of society, policemen and women in the US are some of the most convenient …

While we wait patiently for the return of Amazon’s Rings of Power and a whole new series of Lord of the Rings movies, Wētā Workshop …

On Friday, April 5, Apple upended years of precedent by updating its App Review Guidelines to allow retro game emulators on the App Store. Less …

Given the creeping encroachment of AI into almost every aspect of modern life — from making music to helping Google maintain even more of a …

The top show on Max right now isn’t the last season of Curb Your Enthusiasm, The Jinx − Part Two, or The Sympathizer. No, the …

Since PlayStation announced PS VR years ago, rumors of a virtual or mixed-reality headset coming from Xbox have swirled. With Meta’s latest announcement, that dream …

Scientists have watched two lifeforms merge in a once-in-a-lifetime evolutionary event. The event is so rare that scientists say it has only ever happened twice …

Early reports suggest iOS 18 is going to be packed with AI features, and Apple is continuously hinting at that. We’ve seen published papers, CEO …

I’m getting more strategic than ever with the TV shows I stream these days, largely because there’s just so much available across all of the …

Launched on November 1, 2019, Apple TV Plus is home to Apple’s original TV shows, movies, and documentaries. With an award-winning catalog, users can stream …

Nintendo just hosted its Indie World Showcase on April 17th to highlight a ton of indie games coming to the Nintendo Switch this year, and …

AirPods are unquestionably among the most popular headphones in the world. It’s great that there’s so much variety in the Apple AirPods lineup, but the …

iOS 18 will be available with a handful of new AI features. At least, this is what the latest reports and rumors believe. In his …

With new iPad Air and iPad Pro models expected for early May, the inventory for the Air lineup seems to be dwindling. Usually, when Apple …

When it comes to dedicated health and fitness trackers, everyone knows that Fitbit is as good as it gets. Plus, newer Fitbit smartwatch models offer …