Head of NASA claims China is conducting military experiments in space

NASA’s administrator, Bill Nelson, is once again making some pretty big claims about China’s ongoing space missions. While it is no secret that China’s secret …

NASA’s administrator, Bill Nelson, is once again making some pretty big claims about China’s ongoing space missions. While it is no secret that China’s secret …

tvOS 17.5 beta 3 is now available to everyone with an Apple TV that can run tvOS. At this moment, it’s unclear what this operating …

Apple has just released macOS 14.5 beta 3 to developers. At this moment, it’s unclear what features this software update might bring, as we haven’t …

Apple just released iOS 17.5 beta 3 to developers. This might be Apple’s last iOS 17 update for iPhone users before it unveils iOS 18 during the WWDC 2024 keynote …

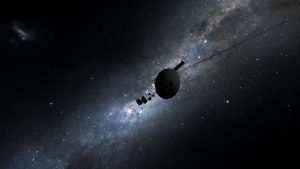

After five months of gibberish, Voyager 1 is finally talking to NASA again. The 46-year-old probe randomly started submitting funky data to NASA back in …

iPad users rejoiced once Apple introduced the Weather app in 2022 with iPadOS 16. However, another iPhone software was still missing from this release, which …

The Samsung Galaxy Tab A8 tablet is one of the best all-around tablets that Samsung makes. It’s the ideal balance between price and performance, giving …

Apple usually holds spring events. With several rumors about new products, the company may be considering a presentation for the next month before it unveils …

Today, Apple announced a special event for May 7. The company will likely announce the new iPad Pro, iPad Air, Apple Pencil 3, and Magic …

There are so many great daily deals out there on Tuesday that we almost don’t know where to start. How about popular Nooie smart plugs …

Sonos has always been one of the companies that supports a heck of a lot of audio-based services. From music streaming services to podcast players …

Over the weekend, a leaker declared that FineWoven cases were done, and Apple would move on to a new fabric for its premium cases. Surrounded …

Apple’s AirPods 3 are among the most popular earbuds out there right now. That’s to be expected, of course, since AirPods are super popular in …

For being as necessary as they are to the orderly functioning of society, policemen and women in the US are some of the most convenient …

While we wait patiently for the return of Amazon’s Rings of Power and a whole new series of Lord of the Rings movies, Wētā Workshop …

On Friday, April 5, Apple upended years of precedent by updating its App Review Guidelines to allow retro game emulators on the App Store. Less …

Given the creeping encroachment of AI into almost every aspect of modern life — from making music to helping Google maintain even more of a …

The top show on Max right now isn’t the last season of Curb Your Enthusiasm, The Jinx − Part Two, or The Sympathizer. No, the …

Since PlayStation announced PS VR years ago, rumors of a virtual or mixed-reality headset coming from Xbox have swirled. With Meta’s latest announcement, that dream …

Scientists have watched two lifeforms merge in a once-in-a-lifetime evolutionary event. The event is so rare that scientists say it has only ever happened twice …

Early reports suggest iOS 18 is going to be packed with AI features, and Apple is continuously hinting at that. We’ve seen published papers, CEO …

I’m getting more strategic than ever with the TV shows I stream these days, largely because there’s just so much available across all of the …

Launched on November 1, 2019, Apple TV Plus is home to Apple’s original TV shows, movies, and documentaries. With an award-winning catalog, users can stream …

Nintendo just hosted its Indie World Showcase on April 17th to highlight a ton of indie games coming to the Nintendo Switch this year, and …

AirPods are unquestionably among the most popular headphones in the world. It’s great that there’s so much variety in the Apple AirPods lineup, but the …

iOS 18 will be available with a handful of new AI features. At least, this is what the latest reports and rumors believe. In his …

With new iPad Air and iPad Pro models expected for early May, the inventory for the Air lineup seems to be dwindling. Usually, when Apple …

When it comes to dedicated health and fitness trackers, everyone knows that Fitbit is as good as it gets. Plus, newer Fitbit smartwatch models offer …

I don’t know if there has ever been a movie that I’ve anticipated more than the one that is coming out on July 26th. Maybe …

With the iPhone 15 rumor cycle, it was expected that Apple could add capacitive buttons to this device. This means the company would remove the …

The shopping experts at BGR Deals are off to a flying start on Monday, with some of the hottest deals of the season having popped …